Having made my predictions for the year, I wanted to follow up with the long-term vendor share developments in the ITC industry. In the Figure above I show market shares for the top 12 suppliers in the years to then of September in 2009 and 2019. There have been a lot of changes of course such as the rise of Apple and Samsung and the decline of HP (now split between Inc. and Enterprise) and IBM. Over the years Apple and Microsoft have replaced France Telecom and Nokia in the list. Read more »

ITCandor publishes its predictions for the ITC industry in 2022

PRESS RELEASE – Didcot, December 31st, 2021

ITC 2022 – predictions for a better year

ITCandor has published its 12th set of annual predictions. These are the 10 ideas for the ITC industry in 2022: Read more »

ITC 2020 20:20 – predictions for the New Year

Encouraged by the accuracy of my last year’s predictions, I’m keen to share with you my vision for the ITC industry in 2020. This is a summary of my predictions:

1. The overall ITC market will grow by 0.8% to $6.849 trillion

2. The Americas will lead regional ITC spending growth

3. Spending on software will grow most, while hardware spending will decline

4. The business market grows; the consumer market continues to fall

5. IT Services spending grows most on IaaS and PaaS cloud services, while other offerings ‘flat line’

6. The only hardware spending growth will be on solid state disks and processors

7. Wider adoption of 5G allows spending on mobile telecom service to grow

8. SaaS and Infrastructure will lead the software market

9. Raw storage shipments exceed 2 Zetabytes

10. Governments move against those trading data from social networking

The ITC market is so large – and mature in many countries – that it will show little overall change in 2020; however, like a swan gliding on a lake, its passage may look smooth, but there’ll be a lot of paddling under the water.

1. The overall ITC market will grow by 0.8% to $6.849 trillion

2. The Americas will lead regional ITC spending growth

On a regional level (see my Figure) I expect the Americas to do best with a 1.6% growth to $2.659 trillion, followed by Asia Pacific (+0.8% to $2.187 trillion); I expect business in EMEA to decline slightly by 0.1% to $2.006 trillion. Americas’ rise in the chart is due in part to my use of constant dollars for comparisons, but in 2020 I still expect it to grow most if we use local currency spending.

3. Spending on software will grow most, while hardware spending will decline

If we look at the long-term development of the ITC market by broad categories of offerings (see my Figure) we see that both IT Service and Software have been growing faster than Telecom Service and Hardware. In 2020 I expect this trend to continue; the strongest growth will be in the software area (+3.0% to $1.163 trillion), followed by IT service (+1.8% to $2.019 trillion) and Telecom Service (up +0.7% to $2.334 trillion); I expect hardware spending to decline by 2.2% to $1.333 trillion.

I expect spending on software to overtake hardware in 2026 and IT to overtake Telecom Service sometime after that. However I would guard you against making too many decisions on the differences between categories; the growth of cloud computing demonstrates how hardware can be sold ‘as a service’, but the industry still needs to build and runs servers.

4. The business market grows; the consumer market continues to fall

2015 was the last time consumers beat business in terms of spending growth on ITC offerings. I expect this to continue throughout my forecast to 2026. In 2020 businesses will spend 1.9% more, while consumers spend 0.8% less than in 2019.

One reason for this is the increasing centralization of computing in areas such as data streaming; another is the declining spending on smart phones, tablets and other devices. There are still places on the globe that are not fully engaged in using the Internet for information and shopping, such as many parts of Africa, some Asian Pacific countries and much of Eastern Europe; however I don’t predict a rapid change in coming years as the social, economic and political changes necessary will continue to move a slow pace… and won’t make up for the falling spending in advanced countries due to high levels of penetration. Vendors of consumer ITC offerings need to concentrate on genuine improvements in functionality, which will be helped somewhat by wider adoption of 5G network services.

5. IT Services spending grows most on IaaS and PaaS cloud services, while other offerings ‘flat line’

There will continue to be major differences in spending growth on IT Services, which I predict will grow 1.8% overall. Leading the charge will be IaaS and PaaS cloud services, which I predict will grow by 23.9% and 16.6% respectively in 2020. Of the other offerings implementation will remain the largest (growing by 1.5% to $592 billion) and Software Maintenance will grow the most (2.0%) to $350 billion.

The major ongoing change in cloud services is the attempt by large organizations to manage them inline with their internal resources, often referred to as ‘multi-cloud’ or ‘hybrid cloud’. While this is not to the advantage of market leader AWS, it will help longer established suppliers to succeed, as long as they develop strong offerings to compliment their experience of assisting enterprises.

6. The only hardware spending growth will be on solid state disks and processors

The hardware market will decline by 2.0% overall and only two product types – solid state drives and processors – will grow in 2020 (please note that I have excluded OEM sales from this forecast). Mobile device will be the one on which we spend most, but it will be 1.3% less than we did in 2019.

Within the product types there will be stars that help sustain business levels, such as solid/3D printing in peripheral, as well as smart wearables and IoT devices in mobile device areas. Dependent on the delivery date of new gaming consoles by Sony and/or Microsoft, it’s possible that this area will beat my forecast – we’ll just have to see.

7. Wider adoption of 5G allows spending on mobile telecom service to grow

Telecom service will have a good year in 2020, with spending growing by 0.7%. Driving the increase will be the wider adoption of 5G services in mobile telecoms – an area that will grow by 2.8% in the year. The strongest spending growth however will be on Enterprise service (3.8% to $28 billion worldwide).

Of all ITC suppliers Telecom vendors should do best in those countries in which new nationalism is driving politics, because they remain the most national companies in a globalized market. I expect a number of acquisitions of foreign subsidiaries in 2020 in countries such as the USA and the UK.

8. SaaS and Infrastructure will lead the software market

The software market will grow by 3.0% in 2020 and we will spend more on almost every product type. I expect the strongest spending growth to be on the Software as a Service (SaaS) area, with an increase of 5.1% over the 2019 rate (nevertheless the increase in SaaS spending will be much less than on IaaS or PaaS). I expect infrastructure software to have another strong year as well, with spending growing by 4.2%. Application software will remain the largest offering in the software market and I expect it to experience a healthy growth of 3.2% over the 2019 level. I expect the poorest software areas will be Operating Systems (virtually flat) and Custom Software (down 2.7% in the year).

Of the four categories Software has the highest profitability, which I expect to improve over 2019 levels to generate a total of $247 billion for its suppliers.

9. Raw storage shipments exceed 2 Zetabytes

Spending on raw storage (which in this case includes OEM shipments) declined by 24% to $172 billion in 2019 following two years of strong growth (37% in 2017 and 18% in 2018); nevertheless shipped capacity continued to increase, reaching 1.683 Zetabytes. While the creation of new products with much larger capacity is not the preserve of only chip-based NAND and DRAM products, we are beginning to see solid state devices overtake spinning disks in most IT devices.

I predict that there will be strong capacity growth in 2020 with the total exceeding 2 Zetabytes for the first time. We live in a world in which increasing amounts of trade and social interaction are done digitally, requiring a mass of storage to record them. Raw storage is a difficult product area to master and consequentially there are few suppliers and the market moves in a jagged way as smaller die sizes drive capacity growth, which I refer to as ‘stochastic’. I don’t expect this to change in 2020.

Navigate our predictions – intro 1 2 3 4 5 6 7 8 9 10

10. Governments move against those trading data from social networking

The Web remains broken; a handful of malign actors continue to exploit the privacy of hundreds of million of users every day, selling their data to other suppliers, perverting democracy and creating disruption.

2020 will be a year in which some governments begin to take tougher action. In the EU and state of California there is now legislation making it illegal to collect or process private data without the user’s express permission. I expect more countries and regions to join them in the year and a number of high profile legal cases in the year resulting in multi billion Euro and dollar fines and even the banning of a few famous dot com suppliers altogether.

Unfortunately I think 2020 will be too early for governments to address the intervention of foreign governments in elections – mainly because those in office tend to be the ones that have benefited most. Nevertheless I hope that we will see new legislation to combat this newish form of corruption as soon as possible.

Fixing the Web will be difficult, but I especially welcome the actions of Tim Berners-Lee, its inventor, both in his sponsorship of the Contract for the Web and in his ideas of separating data from applications in his Solid development. I hope at least that we’ll be able to see that, in his terms, there will be more ‘roses’ than ‘thorns’ to look back on this time next year.

I wish all my readers a fantastic and successful 2020.

Navigate our predictions – intro 1 2 3 4 5 6 7 8 9 10

Martin Hingley, December 31st 2019

ITCandor’s 2019 predictions – a self-assessment

Its time to make predictions for 2020; but before I do I want to appraise those made for this year. As always, I’ve marked each between 1 and 10 based on their accuracy.

| No. | My top 10 predictions | Score | Comment |

| 1 | The market grows by just 0.8% worldwide | 9 | The market grew by 0.6% to $6.8 trillion |

| 2 | ITC manufacturing stays in the Far East despite new nationalism | 10 | Despite trade wars between the US and China, almost no IT hardware manufacturing moved |

| 3 | Cyber security goes multi-tenant and cross-border | 7 | MDR vendors continued to grow as a proportion of all cyber security spending |

| 4 | The EU suffers post-Brexit blues | 8 | ITC sales in the EU declined, although it wasn’t ‘post-Brexit’ as the departure of the UK was delayed! |

| 5 | Cloud wash 2019 – investment costs spiral; the bubble bursts for some | 7 | Total IaaS/PaaS spending grew by just 19% to Q3; a number of smaller suppliers sold their data centers |

| 6 | Large organisations adopt multi-cloud management and better data governance | 10 | ‘Multi-cloud’ has become a by-word for large organisations engaged in digital transformation projects; ‘one version of the truth’ data approaches are increasing to comply with data privacy legislation |

| 7 | IT and OT convergence will be limited by differences in expectations and market views | 7 | HPE and other vendors addressing IoT and factory automation are still in advance of most beyond most user OT strategies |

| 8 | European and Japanese suppliers fall behind US and Chinese ones | 10 | Revenue growth was -3% of European, -2% for Japanese, +1% for US and +3% for Chinese vendors (in constant dollars) |

| 9 | 5G, SD WAN, NVMe over Fabric will drive ITC hardware growth | 8 | Products with these features grew in a market which otherwise declined. |

| 10 | Algorithms and robots challenge our privacy and ethics | 10 | Virtually nothing was done to limit the use of algorithms and targeted advertising to disrupt elections; vendors continued to succeed by selling private data without the owners knowledge or consent |

Overall I claim an 86% accuracy for the year – a better result than in 2018.

Exchange rates v $US in Q3 2019 – Egypt best, Venezuala worst

Understanding currency changes is vital to sizing ITC markets in multiple countries. In this post I look at the changes in value against the US Dollar, which I use as the standard measurement for the world market. I am grateful to OANDA, which gives historical rates and from which I take daily weighted average rates for each quarter.

Read more »

Google Sycamore achieves ‘Quantum Supremacy’, but what does that mean?

On October 23nd 2019 Google announced in an article in the magazine Nature that its Californian Sycamore computer had managed ‘quantum supremacy’, using its 53-qubit processors for a calculation in 3 minutes 20 seconds which would have taken 10,000 years to do on the fastest classical supercomputer around today. Read more »

IBM’s Q4 2019 announcements – storage for the AI and container workloads you want to run

Following closely on the heels of the DS8900 launch last month, IBM announced some major storage products (both hardware and software) today at the TechU conference in Prague. My analysis here is based not only on briefing material from Eric Herzog and his team, but also from my visit to IBM’s Think UK conference last week, where ecology was very much at the fore. Read more »

Computer peripherals – new strategies for a maturing market

The market for computer peripherals in the year to the end of June it was worth $245b. Read more »

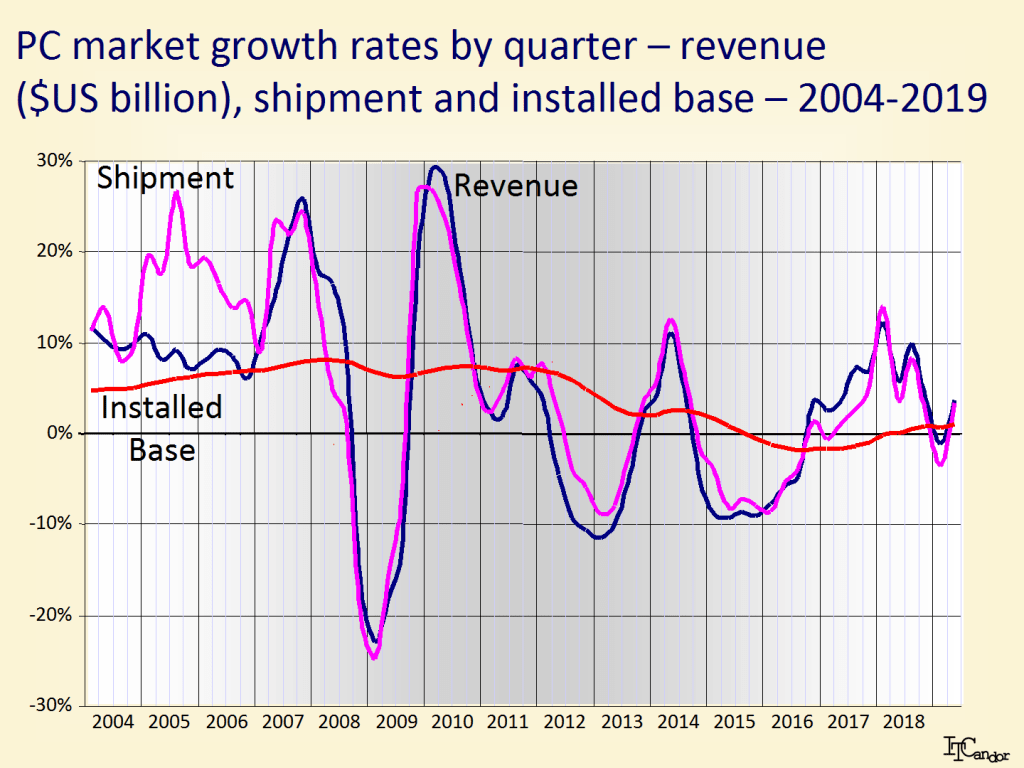

PC market maturity drives new supplier business models

The PC market is now mature with the – slowly declining – worldwide installed base of around 860 million being kept level through shipments of between 55k and 60k per quarter. My Figure above shows the quarterly growth rates of the installed base, revenues (in constant dollars) and unit shipments from 2004 to 2019. Read more »

Storage systems – calm in a stormy storage sea

Spending on storage systems has remained virtually level for number of years, seemingly unaffected by the significant changes in the market mix of raw storage devices. My Figure above shows spending trends on storage systems, spinning disk drives, NAND solid state disk and DRAM memory devices. In the year to the end of June 2019 the market was worth $33.1b and in the second quarter $8.1b – down 2% and 8% respectively on the previous annual period. Read more »