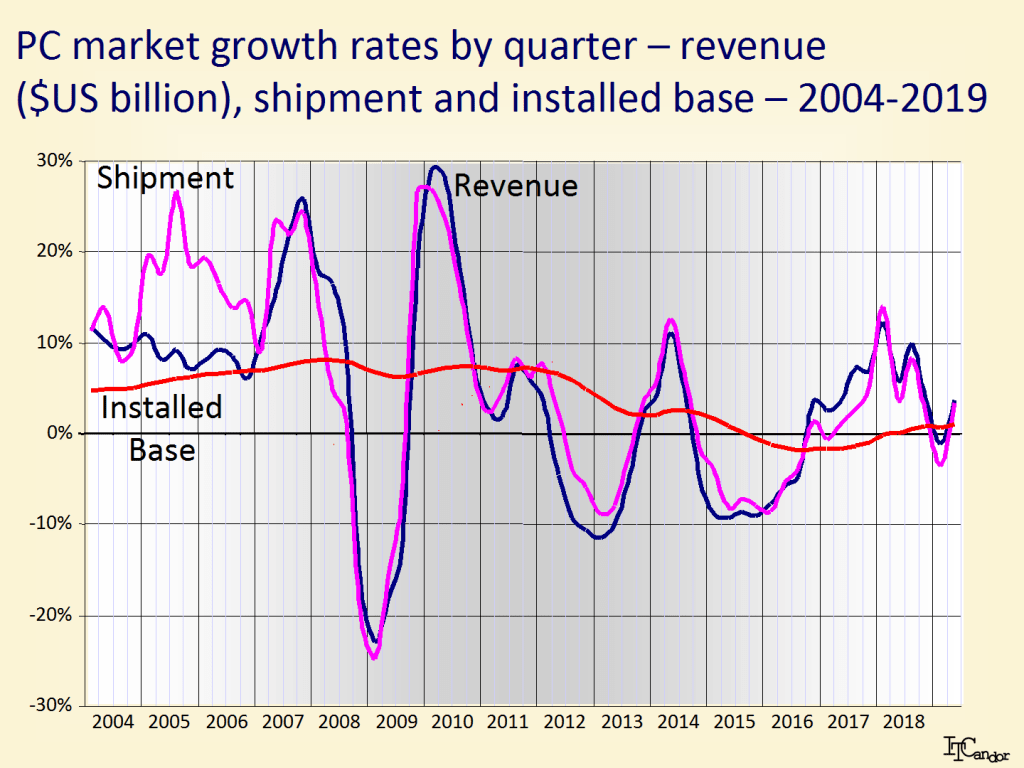

The PC market is now mature with the – slowly declining – worldwide installed base of around 860 million being kept level through shipments of between 55k and 60k per quarter. My Figure above shows the quarterly growth rates of the installed base, revenues (in constant dollars) and unit shipments from 2004 to 2019.

Despite predictions that smart phones and tablets would kill the market, the leading suppliers continue to flourish – in some cases due to market consolidation by taking over manufacturing of machines from smaller vendors deciding to give up. In the last year:

- HP Inc. was the market leader in terms of revenue thanks to its full portfolio of products including more expensive workstations and other high-end machines. HP’s PC business has done particularly well since the company split into Inc. and Enterprise companies in 2015.

- Lenovo was the market leader in terms of unit shipments and installed base. Unlike some other Chinese suppliers Lenovo has built its business mainly through acquisitions, including IBM’s PC division, Medion in Germany and CCE in Brazil; as well as by taking over PC manufacturing from Fujitsu and NEC.

- Dell was in third position in all three measurements. Arguably it has done less well than HP Inc. since its decision to become a private company and then acquiring EMC. Its organisational changes have been more favourable its server business.

Samsung and Apple were in fourth and fifth positions in the year – they have very different strategies with Samsung producing a wide range of standard products and Apple pursuing a high-end strategy and being the only significant vendor with its own operating system, even if its products are based on the same x86 processors as other vendors.

My Figure above shows a market breakdown by form factor with market shares for laptops and desktops. It demonstrates the fact that the leading suppliers have wide portfolios with similar shares in both of the major form factors.

The Americas are now the main regional market for PCs (see my Figure above). Following the Credit Crunch in 2008-2009 Asia Pacific briefly became the main market, but both here and in EMEA there has been a greater decline since 2014.

I expect the PC market to continue to decline over the next few years, but the PC is far from dead – it just needs new strategies for supplier success as they are mainly fuelling replacement activities rather than finding new buyers.

©ITCandor Limited – unauthorised copying of this content is illegal and will be rigorously defended by us through court action